With greater purchasing flexibility, attractive rewards programs, and the potential to build your credit score, credit cards offer a lot of benefits. But that’s only if you use your credit cards smartly. Use it irresponsibly to buy things beyond your means, and you’ll soon find yourself paying hefty interest rates.

Before you even apply for a credit card it’s a good idea to know more about how credit cards work and how credit card interest works. Without understanding these two basic concepts, you could inadvertently find yourself in credit card debt. The deeper you get into credit card debt, the more difficult it can be to break free of this vicious cycle.

How A Credit Card Works

A credit card is basically a line of credit that credit card issuers extend to qualifying applicants. When you apply for a credit card, the issuer will first check your financial credentials. If you meet their eligibility criteria, they will issue you a credit card.

The card issued to you will have terms and conditions that are tailored to your financial circumstances. The lender will set your personalized credit limit and interest rate based on your credit score and other financials. The credit limit acts as the maximum amount you can use in one payment cycle. This limit gets reset at the beginning of each cycle.

When you buy anything using your credit card, you don’t have to pay anything upfront. Instead, your card issuer pays the merchant for you. You have to eventually repay your lender by paying the bill at the end of the billing cycle.

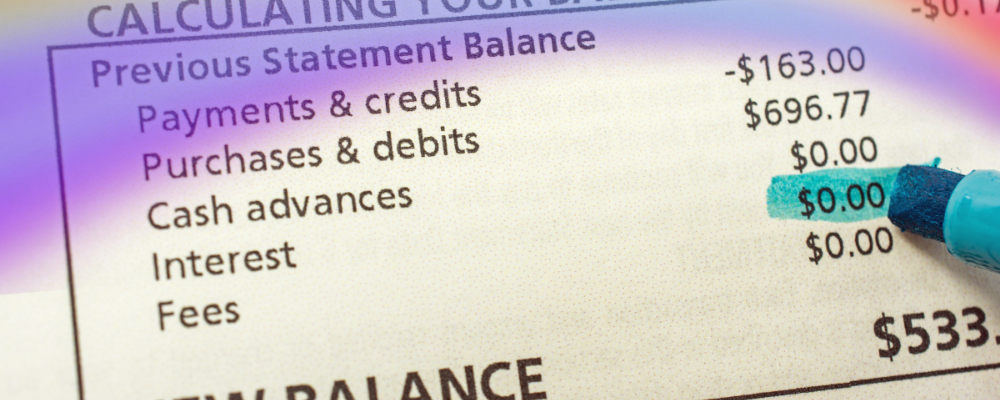

At the end of each billing cycle, you’ll receive a credit cards statement with details of your purchases, the total amount owed, and the due date for the payments. There’s also an option to make a minimum payment, which is a percentage of the total amount owed.

If you pay the bill in full before the payment deadline, you won’t be changed any interest. However, if you make only the minimum payment or you miss the deadline, the lender will charge you interest on the outstanding amount.

So How Does Credit Card Interest Work?

If you’ve been careful about always paying your credit card bills on time, you’ve probably never had any experience with credit card interest. And it’s a good thing too – give yourself a pat on the back.

Credit card interest works quite differently from loan interest. When you take a loan, you start paying interest on the full amount you borrow starting from the day the funds are disbursed. With credit cards, if you pay your outstanding within the due date, you won’t be charged any interest. Interest only kicks in if you miss the payment deadline.

How Is Credit Card Interest Calculated?

You should know, credit cards have the highest interest rates of all forms of debt. This high interest is added to your current balance when you miss a payment due date.

If you fail to pay off the balance in full by the next payment deadline, the total amount you owe will spike dramatically. This is because your card issuer will multiply it every day by a daily interest rate and add that to what you already owe. That means you’ll end up paying interest on interest. The daily interest rate on your outstanding is your APR or annual interest rate divided by 365.

The higher interest rate together with the way it is added to your balance are what cause credit card balances to grow rapidly. If you don’t do something about it in the early stages itself, it will almost certainly get out of hand.

Some credit cards charge different interest rates for different types of transaction. Purchases tend to have a lower interest rate while cash advances usually carry a much higher rate of interest.

How To Eliminate Credit Card Interest Charges

The high interest rates on a credit card can send you spiraling into credit card debt, which can be extremely difficult to get out of. The best way to avoid getting into this debt cycle is to avoid paying any interest at all on your credit card.

The best way to do this is by paying your credit card bill in full before the payment due date. This is the single most effective way to avoid paying interest on your credit card. If you pay off the full outstanding before the deadline and if you don’t have any cash advances, you won’t be charged any interest on your balance.

Can’t Pay Off Your Full Balance by The Due Date?

This can happen to the most responsible credit card user. If you find yourself in this situation, consider paying off as much as you can. Aim to pay at least a little more than the minimum, which is usually about 3% of your outstanding balance. This helps in a couple of ways.

When you pay more than the minimum, you won’t be charged late fees. Also, it reduces the overall balance that’s subject to interest. Anything you pay that’s over the minimum will lower the interest charges even more. This will help reduce the total amount due and will make your credit card debt a little less overwhelming.

Carrying A Balance? Make A Payment As Soon As Possible

We said earlier that your balance incurs interest every day. If you have a balance from the previous month, don’t wait until the end of the billing statement. As soon as you have some cash available, use it to pay off the balance. Paying earlier or more than once a month can help lower the interest charges on the balance you’re carrying.

Understanding how credit card interest works is key to understanding how much it can cost you when you use your card irresponsibly. A good financial strategy is to only buy as much as you can afford to pay off completely by the payment deadline. This is the only way to avoid that dreaded credit card debt.

Now that you know how credit card interest works, let us help you find the right credit card for you.